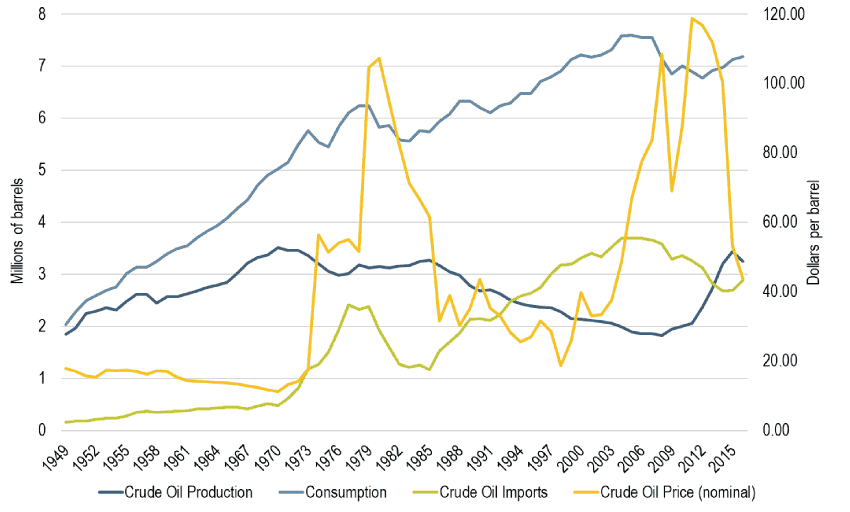

Of the three main transport fuels, jet fuel has been the most affected by the COVID-19 pandemic, given the collapse in air travel. Two-thirds of oil consumption is accounted for by transport. Weakness in oil consumption driven by collapse in air travel As a result of low levels of new investment, oil production is expected to average nearly 3% lower in 2021 relative to 2020.

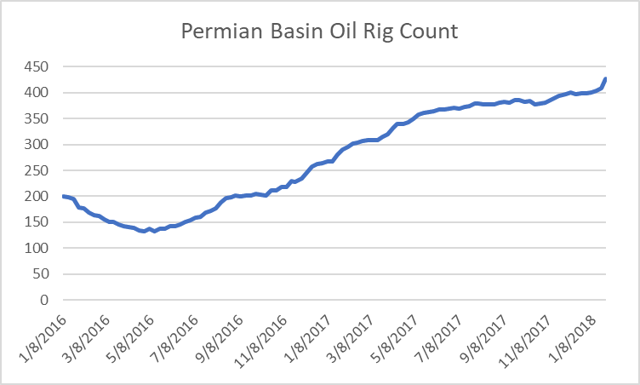

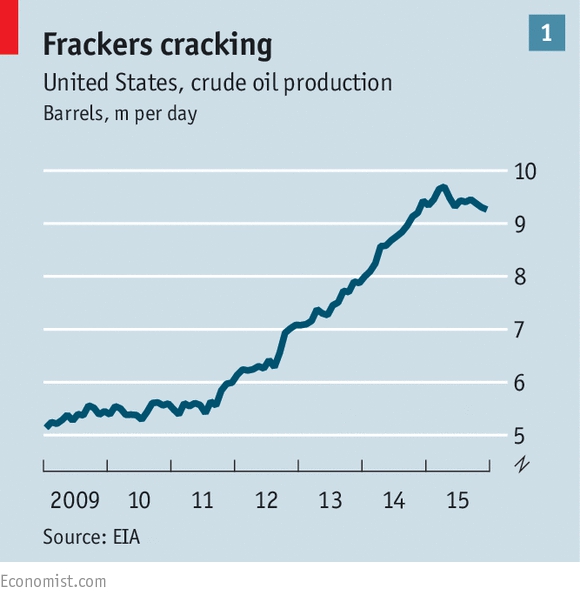

shale companies do not expect a major increase in new drilling until the price of WTI increases above $50/bbl-$10/bbl above its current level. Survey results from the Federal Reserve Bank of Dallas suggest most U.S. The oil rig count, a measure of new drilling activity, fell by 75% to reach an all-time low in August, although it has since seen a modest recovery. Investment in new oil production in the U.S is also very weak. While output has since recovered, it remains around 10% below its 2019 level. Oil production in the United States dropped by one-fifth in May amid plummeting demand and prices. Plunging output and weak activity in the United States However, a nationwide ceasefire was announced in October and a robust recovery in oil production is possible in coming months. Libya had seen production fall close to zero in mid-2020 as a result of internal geopolitical conflict, from an average of 1.1mb/d in 2019. One additional factor is production in Libya, which is a member of OPEC but is not subject to the OPEC+ agreement. A further increase of 2mb/d is planned for January 2021, although this increase could be delayed if oil prices do not see a further recovery. The group agreed to ease the restraints over two years, and this began in August with increased production of 2mb/d. Compliance with the cuts has been high, particularly compared with previous agreements. The fall was driven by OPEC+, which collectively agreed to production cuts of 9.7mb/d. Global oil production plummeted by 12% in May, falling from 100mb/d to 88mb/d, and has remained well below its pre-pandemic level. Unprecedented oil production cuts by OPEC+, strong compliance The rise in oil prices was also helped by a recovery in consumption as lockdown measures were eased and travel and transport began to pick up. Supply also fell sharply in the United States and Canada. The group agreed to cut production by 9.7mb/d, almost 10% of global oil supply. The recovery in prices was driven by a sharp reduction in production, especially by OPEC and its partners, known as OPEC+. The recovery in prices was helped by a sharp fall in global production However, they remain almost one-third lower than their 2019 average.

After rebounding from April lows, oil prices stabilized in 2020Q3Īfter plunging in March and April, crude oil prices saw a robust recovery in May and June, and averaged $42/bbl in 2020Q3. The main risk to the oil price forecast is the duration of the pandemic, including the risk of an intensifying second wave in the Northern Hemisphere, and the speed at which a vaccine is developed and distributed. Oil prices are forecast to rise to $44/bbl in 2021 from a projected $41/bbl in 2020, as the gradual rise in demand coincides with an easing of supply restraint among OPEC+. The pandemic is expected to have a lasting impact on oil consumption, with demand only likely to fully recover by 2023.

While consumption has risen from its lows in 2020Q2, it remains well below its pre-pandemic level. After plummeting in April, oil prices have partially rebounded in response to a steep drop in production, particularly among OPEC and its partners.

0 kommentar(er)

0 kommentar(er)